Your pension, your future: What you need to know this Summer

At OPTrust, we’re here to help you feel confident about your retirement — whether you’re just starting your career, beginning to plan for retirement or already enjoying life after work.

Here’s what’s new and important this season:

Celebrating 30 years: Three decades of paying pensions today and preserving pensions for tomorrow.

What is a defined benefit pension: It offers a predictable lifetime monthly income based on your salary and service—not market performance.

Retirement planning: Learn when you can retire, estimate your pension and prepare key documents.

Investing in a sustainable future: See how our climate strategy supports long-term pension security.

Bill 124 updates: Learn how the repeal is affecting pension recalculations and what it means for your payments.

Beneficiary updates: Keep your information current to ensure your benefits go to the right person.

Your 2024 pension statement: Now available online for easy access and peace of mind.

Your pension is secure: OPTrust remains fully funded for the 16th year in a row.

Explore our new website: Redesigned with members in mind for a smoother experience.

We’re here to help you navigate retirement with confidence—every step of the way.

Celebrating 30 years of paying pensions today and preserving pensions for tomorrow

As we celebrate OPTrust's 30th anniversary, we reflect on three decades of service to our members guided by our values, our vision and a clear mission of paying pensions today and preserving pensions for tomorrow.

The OPSEU Pension Plan was established to give Plan members and the Government of Ontario an equal voice in the administration of the OPSEU Pension Plan and the management of the assets through joint trusteeship.

And three decades later we continue to ensure that we deliver peace of mind in retirement, invest sustainably for the long-term health of the Plan, and create an inclusive and fulfilling work experience for our people.

Thank you for being a part of our 30 years of success!

What is a defined benefit pension — and why does it matter?

A defined benefit (DB) pension plan provides you with a predictable, secure income in retirement — one that’s based on your salary and years of service, not market performance.

Why it’s valuable:

Lifetime income: You receive a monthly pension for life.

Inflation protection: Many DB plans include cost-of-living adjustments.

Peace of mind: Your retirement income is stable and reliable.

Want to see how it works? 🎥 Watch this short video to learn how a DB pension supports your financial future.

Who doesn't love payday?

Ready to retire? Here’s how to plan with confidence

Planning for retirement is about more than picking a date—it’s about making sure you’re financially and emotionally ready for the next chapter.

With your OPSEU Pension Plan, your defined benefit pension gives you a strong foundation. But there are a few key steps to take:

Know when you can retire: You may be eligible for an unreduced pension before age 65.

Estimate your pension: Use Online Services to see what you can expect.

Understand your options: Learn about bridge benefits, survivor pensions, and insured benefits.

Get your documents ready: Proof of age, spousal status, and more may be required.

Start planning today—and feel confident about your future.

🎥 Watch our recorded webinar to learn how to prepare for retirement with OPTrust.

Ready, set, retire!

Bill 124 repeal: What it means for your pension

The repeal of Ontario’s Bill 124 has resulted in retroactive wage increases, which may affect your pension contributions and benefits.

OPTrust began recalculating pensions in late 2024. As employers send updated salary data, we’re adjusting monthly pension amounts and issuing any retroactive payments. This process will continue throughout 2025 due to the high volume of updates.

If you’re still working

You don’t need to take any action. Your pension records will be updated automatically once we receive the necessary information from your employer.

If you’re retiring or leaving the Plan

We’ll process your request without delay. If your pension changes due to updated salary data, we’ll contact you directly.

We’re committed to keeping you informed. For the latest updates, visit optrust.com.

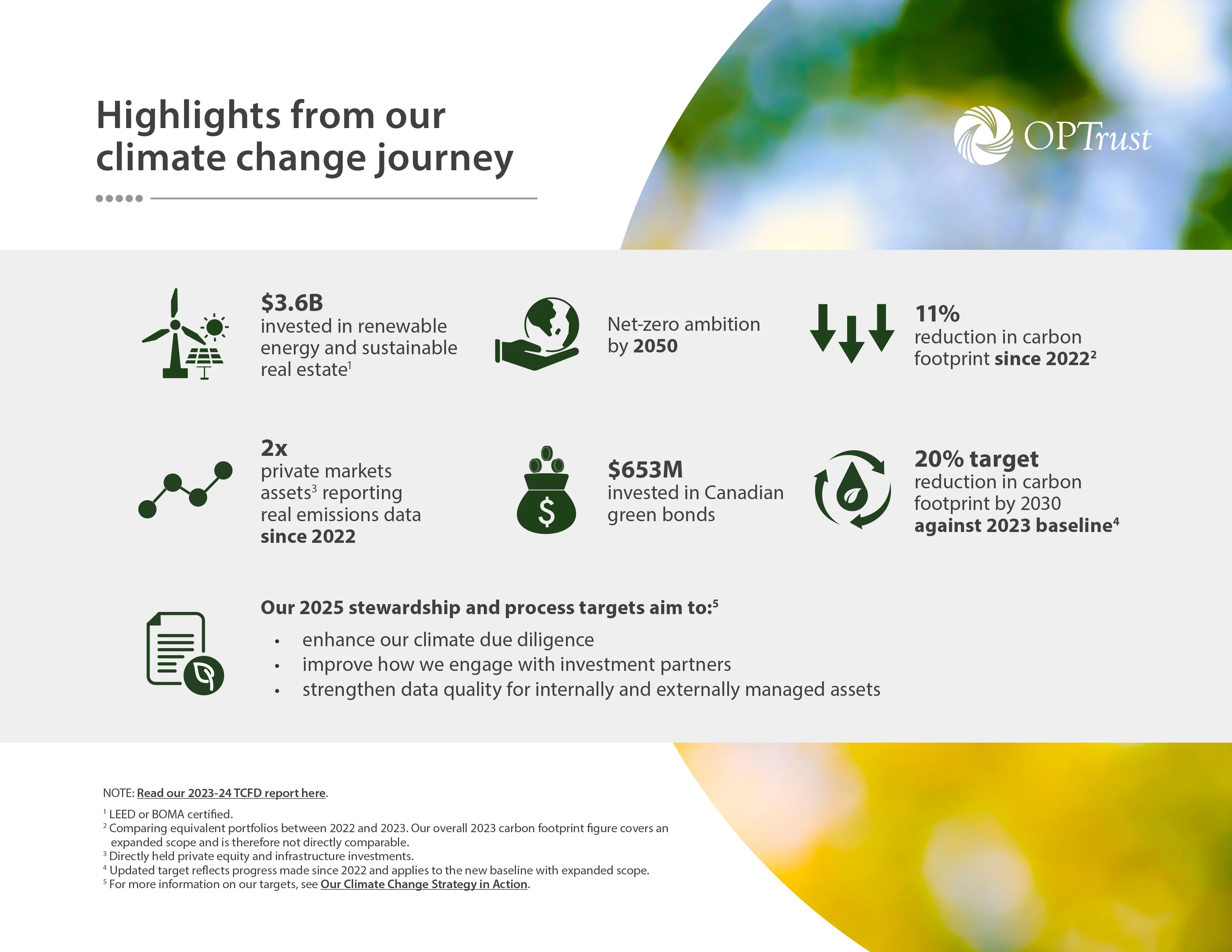

Investing for resilience: OPTrust’s climate strategy in action

Our dedication to managing climate risk is a core piece of our long-standing Responsible Investing program. We endeavour to increasingly embed climate risks, alongside other material ESG factors, into the way we do business across the organization to ensure we rise to the challenge as investment best practices evolve in the decades ahead.

OPTrust is taking meaningful steps to protect the long-term value of your pension by addressing climate-related risks and opportunities. Explore key milestones and ongoing progress in our enhanced climate change strategy.

Key highlights:

Net zero by 2050 ambition for our investment portfolio

11% reduction in carbon footprint since 2022

$3.6 billion invested in renewable energy and sustainable real estate.

$653 million invested in Canadian green bonds.

By integrating climate considerations into our investment decisions, we’re helping to safeguard the long-term health of the pension plan — while contributing to a more sustainable future.

Small update, big impact: Update your beneficiaries

Your pension is more than just a retirement plan — it’s a promise to protect the people who matter most to you. That’s why it’s so important to keep your beneficiary information up to date.

Life changes — marriages, divorces, births, illnesses or the loss of a loved one — can all affect who you want to receive your pension benefits. If your spousal and beneficiary information is outdated, your survivor benefits may not go to the right person.

Why it matters:

Your spouse at time of retirement or death is first in line for survivor benefits after you pass away.

Keeping your information current ensures your wishes are honored.

It helps your loved ones avoid unnecessary delays or complications.

Take a moment to review: Updating your spousal and beneficiary information is quick and easy. Simply log in to your secure online account or contact us directly for assistance.

🔗 Update Your Beneficiary Information Now →

Your pension snapshot is just a click away!

We’re excited to let you know that your 2024 Annual Pension Statement is now available through our Online Services portal. It’s a great way to stay informed about your retirement benefits and ensure everything is accurate and up to date.

Here’s what you’ll find in your statement:

Your retirement date(s) and your projected pension amounts

Any updates from the past year

Helpful details to keep your records current

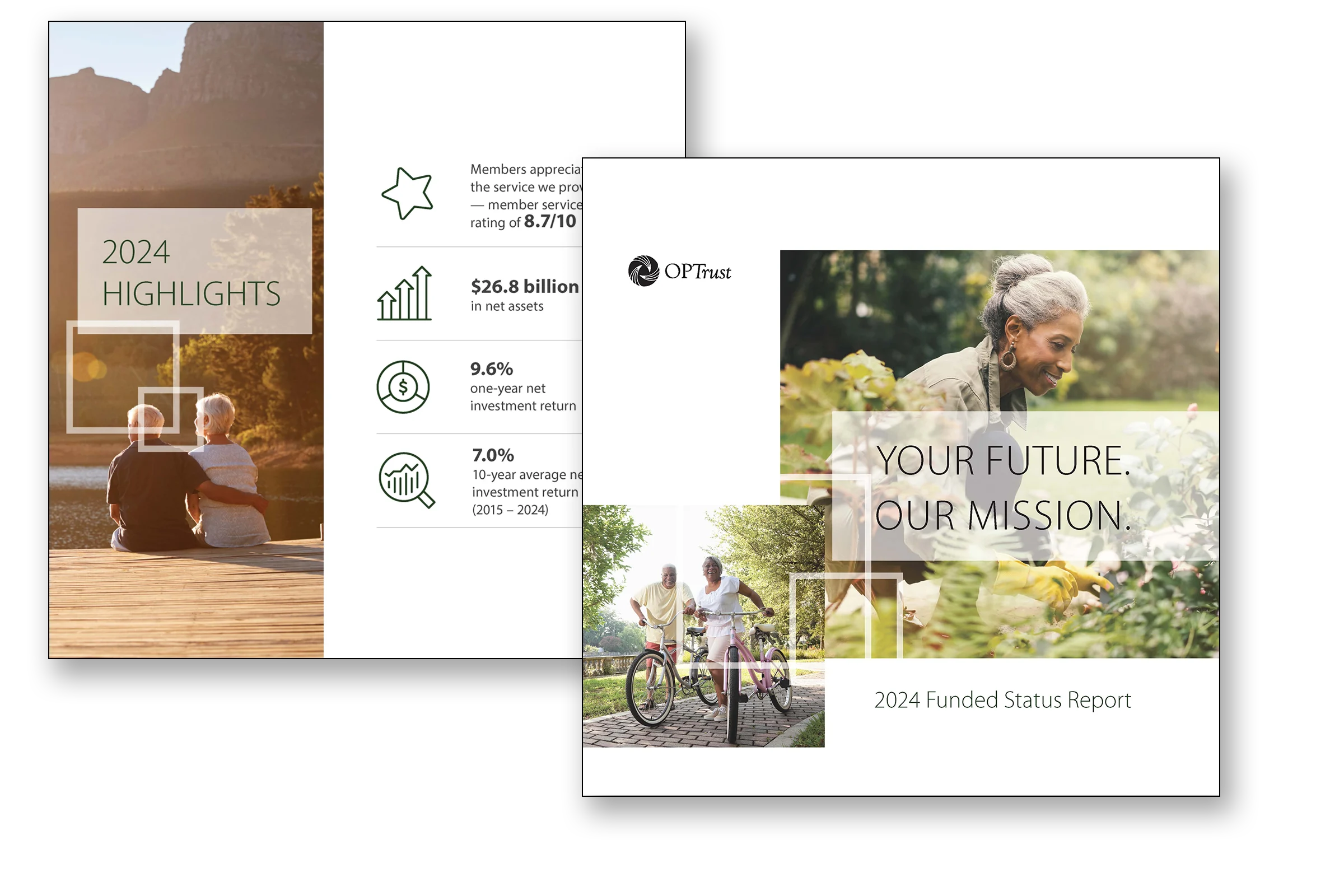

Your pension is secure – 16 years and counting

We’re proud to share that OPTrust is fully funded for the 16th consecutive year, as highlighted in our 2024 Funded Status Report, which means OPTrust for the 16th year in a row is able to ensure a stable and predictable retirement income for when you retire. Being fully funded ensures we can pay pensions today and preserve pensions for tomorrow.

This means your pension remains secure, stable and backed by strong investment performance — even in uncertain economic times.

Here’s what members should know:

Fully funded for 16 consecutive years

$26.8 billion in net assets

$1.4 billion in pension entitlements were paid in 2024

9.6% one-year net investment return

8.7/10 member satisfaction rating

Nearly 70,000 life events supported in 2024 — because we’re here for you at every stage of your retirement journey

Thanks to our long-term investment approach and commitment to responsible investing, we continue to deliver on our mission: paying pensions today, preserving pensions for tomorrow.

Explore the new OPTrust.com – simpler, smarter and designed for You

We’re thrilled to introduce our new and improved OPTrust website, created with your needs in mind. Whether you’re checking your pension details or looking for helpful retirement resources, everything is now easier to find and use.

What’s new for members?

A cleaner, more intuitive design

Quick access to pension info

A dedicated section for members

Take a look around to see what’s new!

We’re committed to making your online experience as smooth and helpful as possible. If you have feedback, we’d love to hear it!